When you are employed by a large company, you have fewer concerns about taxes. Your employer handles most of that, which is a perk of traditional employment. But, when you go freelance and start working for yourself, the burden of responsibility shifts to you. Ignorance of the laws does not exempt you from responsibility.

Poker and taxes are a big mystery for some. Do players need to pay tax on poker winnings like income or is it exempt, like a gift from a family member?

We'll figure out if you need to pay taxes on live or online poker winnings, speaking mainly about American tax laws. This guide will also explain penalties, the filing process, and more.

Understanding Tax Laws on Online Poker Winnings

In the United States, all gambling winnings are subject to taxation. The tax rate you pay depends on whether you are a professional poker player or an amateur.

How much tax on poker winnings is paid?

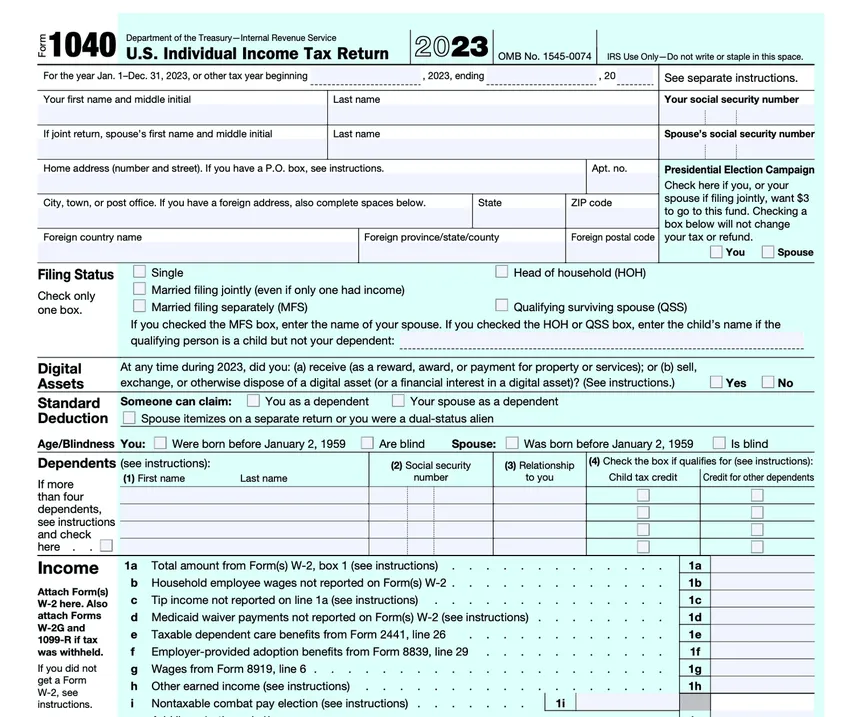

Professional poker players, who earn most of their income from poker, must file their taxes using Form 1040 and pay income tax based on the current tax brackets, which range from 10% to 37%. Amateur players, who make a profit from poker but do not rely on it as their primary income source, should use Form W-2G to report their winnings and pay a flat federal gambling tax rate of 24%.

How much of your poker winnings are taxed?

When calculating your taxable winnings, subtract your buy-ins from your prize money, as you only pay tax on profits. Non-cash prizes like holidays or cars are also taxable based on their fair market value. Gambling losses can be deducted from your winnings, but only up to the amount of your total winnings.

What is Considered Taxable Income for Poker Players?

When you think about your taxable income as a poker player, it means more than your online and live earnings. Quite literally, everything is included. That means winnings from a poker tournament, live casino cash game, and all of your online games. Keep records of this and be as detailed as possible. Online poker players will have an easier time since their site will keep records of every transaction.

Some players might be tempted to “forget” or overlook some winnings when tallying their income tax, thinking it won’t be noticed. Government entities like the IRS in America or the CRA in Canada will not overlook them (or be happy to discover that you hid them).

It doesn’t matter if you’ve just won a $1,000 freeroll or a $25 spin and go – tally up these winnings for your income tax filing.

The Penalties for Tax Evasion

Tax evasion and tax fraud might sound interchangeable, but they are different terms with different implications. If you dodge, avoid, or knowingly withhold tax, you may be charged with tax fraud. In this case, the charges may be civil or criminal. However, tax evasion is a felony criminal offense, so the penalties will be higher.

If caught evading smaller amounts of taxes, penalties include:

- A fine equal to a percentage of the unpaid taxes

- Additional fines for each month of delay in filing

For more serious cases, prison time could be on the table. Those found guilty of tax evasion could face up to 5 years in federal prison. This would be the most extreme outcome. Lesser outcomes like the loss of social security benefits, credit damage, and liens on property are other consequences tax evaders may face. Americans may even lose their passport when the Department of State decides to not issue or renew it.

How Poker Players File Taxes

To file your taxes, gather all relevant documents, including bank statements. Consider paying estimated quarterly taxes to spread the tax burden over the year. Calculate your net profits by totaling your winnings and losses, and use poker-tracking software or hire an accountant for assistance if needed.

Determine your tax-deductible expenses, which may include travel costs, buy-ins, food and drink during tournaments, and possibly dealer tips. Finally, submit your tax return before the deadline using specialist software or IRS Free File if eligible.

Payment Systems for Poker Players

Electronic payment systems like Skrill and Neteller are popular among poker players for deposits and cash-outs. Cryptocurrency is also becoming increasingly common, as many poker sites now accept payments in Bitcoin and other digital currencies.

On any of the payment options you choose, you’ll get a recorded transaction that you can use for your tax filings. You’ll also get given at least one bonus from the poker room, but maybe two, or even three.

Taking advantage of lucrative promotions offered by poker rooms can boost your winnings. Many special offers are available for different types of players. When registering using certain links, you may also qualify for exclusive bonuses, such as:

- Deposit bonuses

- Daily leaderboard prizes

- Exclusive depositor freeroll tournaments with real money prizes

If you have questions about registering for a poker room, claiming bonuses, or installing software, contact our 24/7 free support service for assistance.